Morgan Search greeting gold to mediocre $3,675 for each ounce by the last one-fourth out of 2025 and probably rise on the $4,100 for each and every ounce by middle-2026. Goldman Sachs likewise programs silver you will reach $3,700 because of the year-prevent 2025. Key catalysts is anticipated dovish economic rules from the U.S. Government Set-aside, and therefore usually reduces the options cost of holding low-yielding assets, persistent geopolitical tensions driving secure-sanctuary demand, potential You.S. dollars weakness, and ongoing issues about inflation. This type of things are expected to produce an energetic business which have tactical money opportunities in the middle of potential small-term volatility.

Gold buyers to stay worried about governmental and you can geopolitical headlines

- On the Friday, silver produced a new closing highest, its high everyday close-in records.

- Gold’s seated near peak account pursuing the a continual rally you to definitely’s live more a year.

- Although some highest investors features registered the market, Bitcoin does not have gold’s long history as the a secure haven while in the days of drama.

- Presenting a new 3×step 3 build and you will silver mining theme, Silver Rally pressures people to earn large having symbols such dynamite, silver taverns, and you will balances.

While the an enthusiastic economist at heart, Eren happy-gambler.com my company Sengezer focuses on the new evaluation of your own small-name and you may a lot of time-term has an effect on of macroeconomic study, main bank formula and you can governmental developments for the financial assets. The fresh chart below highlights the difference between place Silver cost (blue range) plus the COMEX Futures prices (purple line). President Donald Trump’s tariff principles, that could push rising prices and you will ignite exchange conflicts. For the Friday, Trump purchased a good probe to your possible the newest tariffs to the copper imports, adding to suspicion. When you’re rising cost of living concerns normally assistance gold since the a secure-refuge resource, highest You.S. Treasury output and a stronger dollars are capping gains on the Wednesday.

Buyers must also individually consider whether or not the ESG financing device matches their ESG objectives otherwise requirements. There’s no warranty one to a keen ESG paying means or process working was profitable. Previous overall performance isn’t a guarantee or a reliable way of measuring upcoming results. Whenever interest levels rise, bond prices fall; usually the lengthened a great bond’s readiness, the greater amount of painful and sensitive it’s to that chance. Ties can also be susceptible to name risk, which is the exposure the issuer have a tendency to receive the debt at the their choice, completely or partially, before the scheduled readiness time.

Main banks also are anticipated to keep leading to the holdings, which will give help. Which means a nearly 20% obtain merely a handful of months to the 12 months. Gold’s excellent performance happened to be enough to outpace the new S&P 500 in the Q1. The favorable Market meltdown try the final date gold taken before the stock exchange, underscoring the fresh desperation of current fiscal conditions as the people seek out a means to cover their wide range. To possess investors, silver means permanence and you may investment maintenance; silver offers deeper small-name opportunity.

Stop of Thread Bull Market Sparks Interest in Hard Assets

Main banking institutions trying to broaden its overseas supplies provides buoyed gold’s well worth. Expanding central financial orders, declining rates, and you may increased geopolitical tensions are creating an excellent “primary storm to have silver,” ING made in a current search note. Sometimes road erodes believe within the report property, strengthening Schiff’s part you to investors may begin in order to tough property such silver and gold gold coins as the trust in United states financial government goes out. Of several experts try evaluating the modern economic climate to this away from the newest seventies before cost savings inserted almost 10 years from corrosive stagflation.

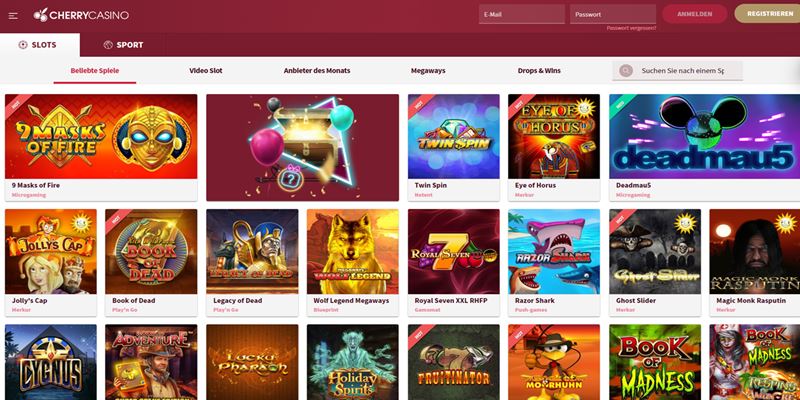

Casino Bonuses

“Silver is often seen as a hedge up against uncertainty, however the hedge is going to be unwound.” “The newest rally we come across this week … is part of the things i manage phone call the fresh ‘work with it hot’ trading,” Rodda informed Al Jazeera. Subscribe thousands of smart people which found professional study, business condition, and exclusive sales weekly. He’s found to possess illustrative objectives only and do not portray the new overall performance of every specific funding. The fresh indices commonly at the mercy of costs otherwise charges and are usually made up of securities or other money tool the newest liquidity out of that is not limited. A particular funding device get include bonds notably diverse from those who work in any list described here.

On the right of the grid, you’ll discover three people driving a coal cart from the caves, its phrase at the same time demented and terrified while they hurtle for the dark. Above him or her, there are tabs appearing the Bet, Borrowing from the bank, Victory and you will Line Wager, and you will underneath the grid alone you’ll find buttons for Spin, Bet One to, Bet Maximum and you may Paytable. Historically i’ve accumulated matchmaking for the sites’s top position games builders, anytime another online game is about to lose it’s likely i’ll learn about it very first.

Bitcoin Worry List Attacks Annual Lower, Bitwise Notices To find Chance

Although not, the new recovery appears brief-existed, which have wider geopolitical dangers and you can unsolved European union-All of us trade discussions staying individual belief protective. Out of Oct ten to twenty-six, consumers spending Dhs500 or even more from the silver, accessories, and discover areas is get into a great raffle to help you winnings coins and you can taverns, with two champions selected a week. Eric Sepanek is the inventor out of Scottsdale Bullion & Coin, established in 2011. That have extensive knowledge of the newest gold and silver coins world, he or she is dedicated to educating People in america to your wide range conservation strength out of gold-and-silver. Sean Brodrick songs the brand new prompt-rising arena of precious metals and you may critical vitamins that are reshaping global have organizations. Their fieldwork, sharp business belief and you may capacity to place higher-profit-prospective options render Weiss Ratings clients an edge — a long time before Wall surface Highway catches to the.

Political And you will Economic Suspicion Drive Demand

Gold and silver coins have taken heart stage in the worldwide places, that have gold has just surpassing $4,one hundred per ounce and you can gold climbing above $51, establishing its large accounts to your listing. So it rise provides seized trader interest worldwide, underscoring the new renewed need for real possessions in the course of rising economic uncertainty. Understanding exactly what’s fueling that it gold-and-silver rate rally is very important to have investors seeking browse an explosive globe. Out of Federal Set-aside coverage shifts for the go back of rising prices and you will an upswing out of main lender request, here you will find the five core forces propelling gold-and-silver higher in the 2025 — and just why it number for long-term profiles. Closely display screen biggest main financial monetary policy behavior, such as in the You.S. Federal Set aside, away from interest rates, because the dovish changes have a tendency to prefer silver.

Silver News: Profit-Delivering Stand Rally In the middle of Tariff Uncertainty since the PCE Analysis Looms

If you’d like to winnings the brand new progressive jackpot, you should choice from the limit risk. After you have decided on their risk, you can turn on the new AutoPlay function to let the brand new reels in order to spin themselves for approximately 99 spins otherwise until you result in the fresh Silver Rally Bonus function. Background reveals us one gold will increase in the event the stock market decreases. Part of this can be concern one to reciprocal tariff hikes often kick international economic growth in the teeth.

Gold is just about to split more than $4,150 and you can gold is going to split a lot more than $53. However the chief enjoy is the global rug pull-on the new You.S. dollars and Treasury field. Gold and silver is actually cracking details, and seasoned economist Peter Schiff claims the newest rally’s only starting out. His most recent alerting paints a great stormy picture to your buck, debt, and the future of money by itself. Sobti additional which he expects come across PSU counters from the electricity field to attract solid to buy supposed in the future in the midst of government entities’s proceed to accelerate shelling out for signal, renewable power, an such like. The fresh Indian stock market concluded marginally high for the Friday regarding the Muhurat trade training, extending development to your fifth straight class.

GoldRush Rally now offers an extensive directory of functions built to improve the action for players within luxury vehicle rally feel. The brand new goldRush Rally Team wants to definitely have the greatest experience when you spend with us. Which range from Boston and all of the way to Boca Raton view your luggage within the for the GR Concierge Associates and it also might possibly be waiting for you on your own area when you get to the next attraction.

Silver is even widely named an excellent hedge facing inflation and you will facing depreciating currencies since it doesn’t have confidence in one specific issuer or regulators. The really worth isn’t linked with people unmarried authorities otherwise main lender, therefore it is an excellent hedge not simply against rising cost of living plus against geopolitical chance and money failure. Whether or not your’lso are in the united states, European countries, or Asia, gold are a good universally acknowledged and you may leading investment. The newest silver put price is computed out of gold futures deals to your the fresh Merchandise Exchange (COMEX) to determine the price of silver today. Higher interest levels for extended perform help the possibility price of carrying gold. VanEck’s GDX, the largest silver miner ETF, have sprang twenty eight.8% year-to-time, somewhat outperforming the newest S&P five-hundred, which has lost cuatro%.

The brand new monetary industry are seeing an unprecedented surge inside main bank gold buildup, a phenomenon who has eventually changed the newest silver field land. After many years of being net suppliers or holding fixed reserves, main banking companies features stopped path considerably, getting voracious customers. So it to find spree features viewed annual central bank gold consult exceed step 1,000 tonnes lately, an even not seen in 50 years. The new development suggests no signs of abating, having a bold 95% from central financial institutions pregnant international gold supplies to increase across the next season, and you can a record 43% positively gonna boost their very own holdings. Gold have an enthusiastic inverse correlation for the Us Buck and you can All of us Treasuries, which can be each other significant set-aside and you may safe-sanctuary possessions.